Urban Mirror Correspondent

Â

New Delhi, July 7: The Lok Gathbandhan Party (LGP) today expressed concern over prevailing financial mess in public sector banks in the country. The LGP said now a committee on stressed assets has estimated pumping in of at least Rs 1.3 lakh crore to these banks over a period of two years to improve their financial condition. The party said the government’s plan under “project Shakti†for reconstruction of these ailing banks will be at the cost of tax-payers money.

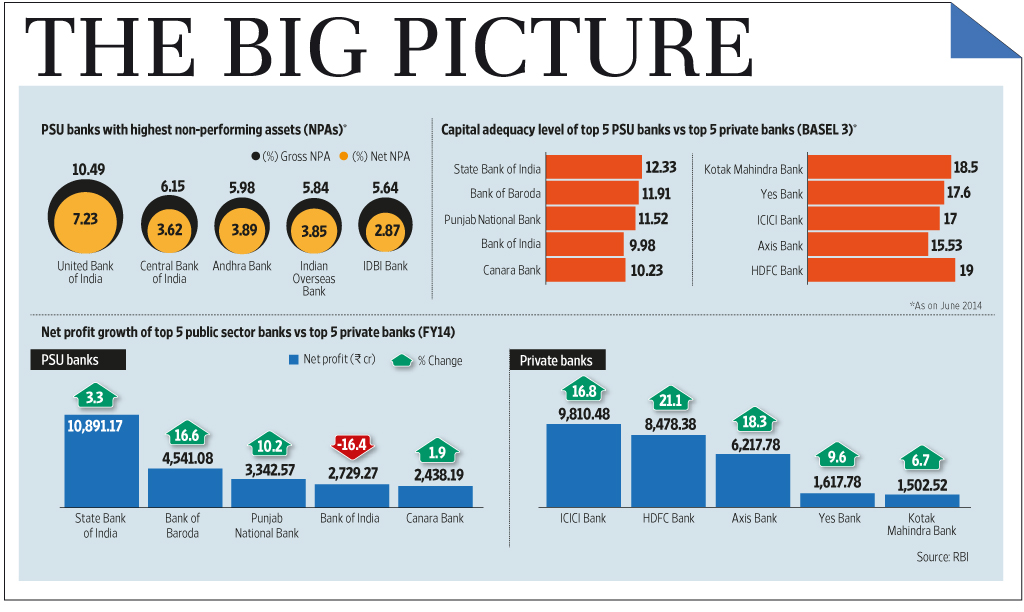

The spokesperson of the party said here on Saturday that the governance structure of public sector banks has crumbled, as they have neither market nor regulatory discipline. The spokesperson said rules and regulations were in place for a long time, but corrupt bank officers in league with politicians and businessmen violated them with impunity, which has now led to the complete messy situation and now non-performing assets (NPAs) have gone up to Rs 10 lakh crore.

The spokesperson said that the NDA government has now come out of hibernation to tighten the regulatory measures but damage has already been done and the banking system will take long time to recover. The spokesperson said the confidence of the depositors has also shaken and the people are feeling disenchanted. The spokesperson said the people have faith in public sector banks because they are state-owned and their money is safe, but the way skeletons are tumbling out of cupboard one by one after PNB fraud, it has exposed soft belly of public sector banks. The spokesperson said this is a financial crisis of immense measures for which successive central governments are fully responsible. The spokesperson said during the last five years, PSU banks have reported 8670 cases of fraud totaling Rs 61, 260 crore and the figure is set to go up with more such cases coming to light during the current fiscal.

The spokesperson said with rampant financial indiscipline and government infusing capital through re-capitalization process to run them, the whole edifice has crumbled. During the past 31 years (1985-2017) the government doled out around Rs 1.5 trillion to these banks to keep them alive, the spokesperson said, adding they have virtually become drain on state exchequer and threat to whole financial structure. The LGP has thus demanded fixing of accountability of bank officers at every level, elimination of political interference in the functioning and tight regulatory measures to stem the rot. (credit images: Livemint.com)